|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

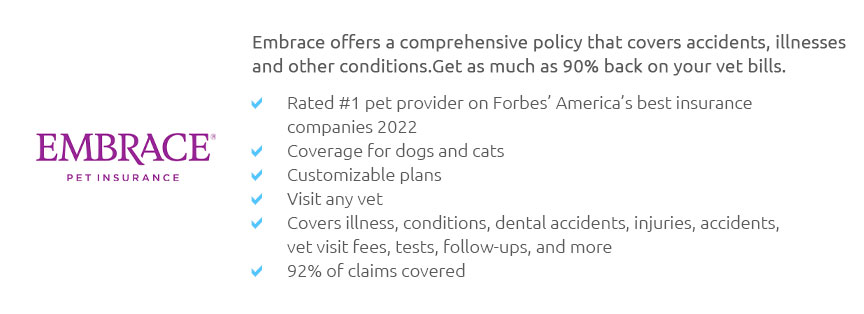

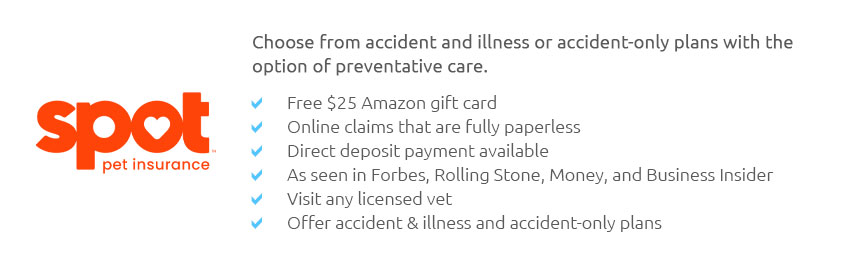

Understanding Ratings for Pet Insurance: A Comprehensive GuidePet insurance has become increasingly popular as more pet owners recognize the benefits of safeguarding their furry friends against unexpected medical expenses. However, navigating the world of pet insurance can be daunting, especially when trying to decipher the myriad of ratings and reviews available online. In this article, we will explore the key factors that influence pet insurance ratings, provide insights into what these ratings mean for you as a pet owner, and offer subtle opinions on how to approach choosing the right insurance plan for your pet. First and foremost, it is essential to understand what pet insurance ratings are and why they matter. Ratings are often an aggregation of customer reviews, expert analyses, and industry benchmarks that provide a snapshot of an insurance provider's overall performance. These ratings can be found on various platforms, including consumer advocacy websites, independent review sites, and sometimes directly on the insurance provider's website. Typically, they assess factors such as coverage options, claim processing speed, customer service, and cost-effectiveness. Coverage Options: A crucial aspect of pet insurance ratings is the range of coverage options available. Comprehensive plans usually cover accidents, illnesses, surgeries, and sometimes even wellness checks. The best-rated insurers often offer customizable plans that allow pet owners to tailor coverage according to their pet's specific needs. This flexibility is a significant factor in achieving high ratings, as it ensures that pet owners are not paying for unnecessary coverage. Claim Processing: The speed and efficiency of claim processing are also pivotal in determining an insurer's rating. Pet owners prefer providers that offer quick reimbursement and a hassle-free claims process. Many highly-rated companies have embraced digital solutions, allowing claims to be submitted and processed online, significantly reducing waiting times and improving user satisfaction. Customer Service: Excellent customer service can make a world of difference, especially when dealing with the stress of a pet's health emergency. Insurers that score high in this area are known for their responsive, compassionate, and knowledgeable support teams who can guide pet owners through the insurance process with ease and empathy. Cost-Effectiveness: Finally, the cost of premiums versus the benefits received is a major consideration. While cheaper plans may seem appealing, they often come with limitations that could prove costly in the long run. Highly-rated pet insurers strike a balance by offering fair pricing coupled with robust coverage, ensuring that pet owners receive value for their money. It is worth noting that ratings can vary significantly depending on the source, which is why it's advisable to consult multiple platforms before making a decision. While consumer reviews provide real-world insights into the customer experience, expert analyses offer a more technical perspective on the insurer's offerings. Combining both viewpoints can give a well-rounded understanding of what to expect from a provider. In conclusion, ratings for pet insurance are an invaluable tool for pet owners seeking to protect their beloved animals without breaking the bank. By focusing on key factors such as coverage, claims processing, customer service, and cost, these ratings provide a reliable gauge of an insurer's reliability and quality. As a subtle opinion, one might suggest prioritizing insurers with a proven track record of customer satisfaction and transparency, as these qualities often lead to the best overall experience. As you embark on the journey to find the perfect insurance for your pet, remember to weigh these ratings carefully, and trust your instincts as a responsible pet owner. https://www.youtube.com/watch?v=xcEQ_U7djac&pp=ygUII2Jlc3RpZTI%3D

Been to the veterinarian lately? You know it's not cheap. If you're like a lot of pet owners, you've probably asked yourself, Should I get ... https://www.pawlicy.com/blog/best-pet-insurance/

ASPCA, Hartville, Spot, and Pumpkin Pet Insurance are the best pet insurance companies for those concerned about how much time they have to file a claim. These ... https://www.consumersadvocate.org/pet-insurance

A comprehensive guide to pet insurance providers, how they work, what they cover, and how to choose the right one for your pet.

|